Is Bitcoin Still Digital Gold in 2026? Gold Outperforms Amid Debate

The “digital gold” label has defined Bitcoin for years — a scarce, decentralized hedge against inflation. Yet in 2026, gold has delivered superior returns while Bitcoin shows higher correlation with tech stocks. This shift has reignited debate: does BTC still deserve the title?

This article examines recent performance data, expert views, community sentiment, and the rising role of stablecoins.

Performance Gap: Gold Leads in 2025–2026

Gold posted strong gains in 2025 (+55% in some reports) driven by central bank buying and geopolitical safe-haven demand. Bitcoin, despite institutional inflows via ETFs, has lagged and exhibited volatility tied to equity markets.

Table 1: Bitcoin vs Gold Performance (2025–Early 2026)

| Asset | 2025 Return | YTD 2026 | Key Correlation |

|---|---|---|---|

| Gold | +55% | Continued gains | Safe-haven flows |

| Bitcoin | Limited/net negative in some periods | Volatile, down ~50% from peaks | Tech stocks (Nasdaq) |

Data drawn from community discussions and market reports as of February 2026.

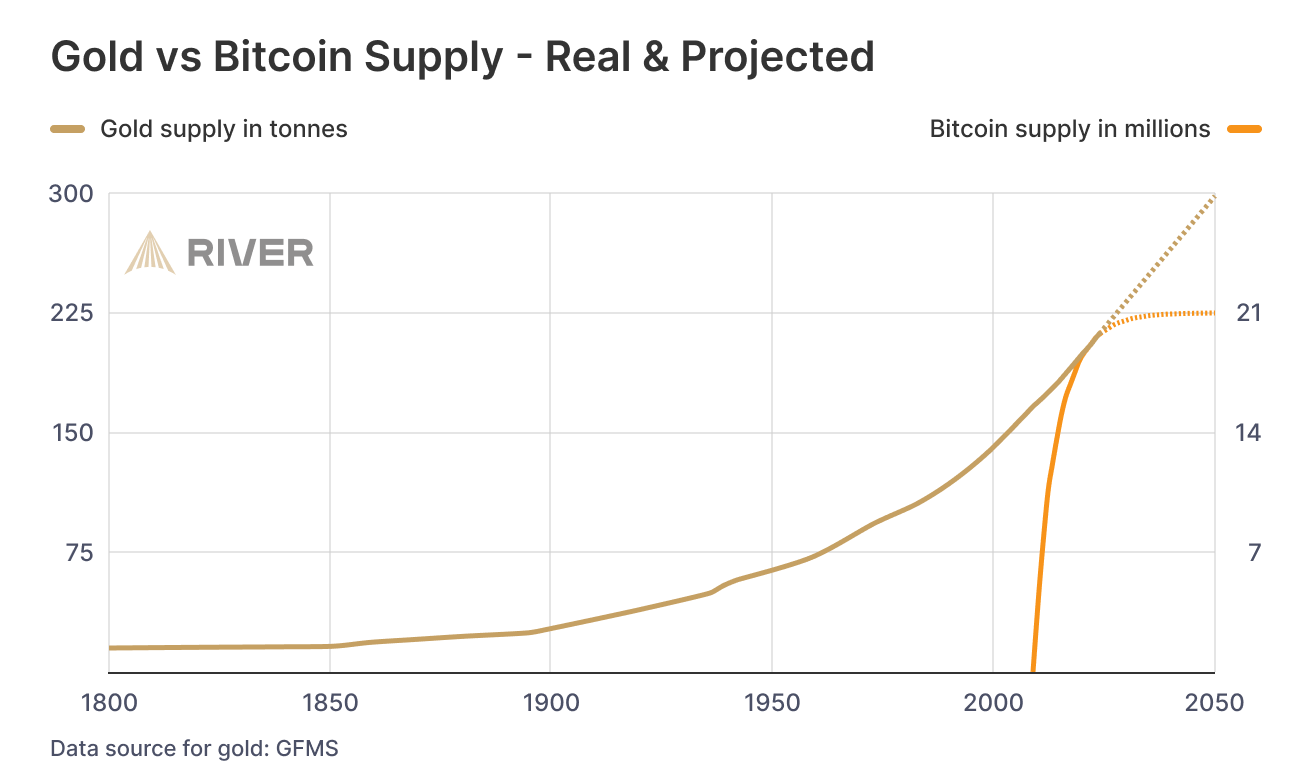

The Bull Case: Scarcity and Long-Term Narrative

Supporters maintain Bitcoin’s fixed 21 million supply and growing institutional adoption preserve its “digital gold” status over multi-decade horizons.

🇺🇸 FED CHAIR POWELL: "Bitcoin is like gold. It's digital gold."

— Bitcoin Teddy (@Bitcoin_Teddy) February 15, 2026

The Bear Case: Risk Asset Behavior and Competition

Critics point to Bitcoin’s correlation with tech equities and failure to rally during risk-off periods. Meanwhile, stablecoins have captured real-world payment and DeFi utility.

Bitcoin Trading More Like Tech Stock Than Gold

— Tusher (@0xtusher_) February 15, 2026

So what’s going on with Bitcoin right now?

Institutions are all in, but they’re not treating it like digital gold they’re seeing it more like a tech stock.

That’s why the short-term price swings seem confusing…

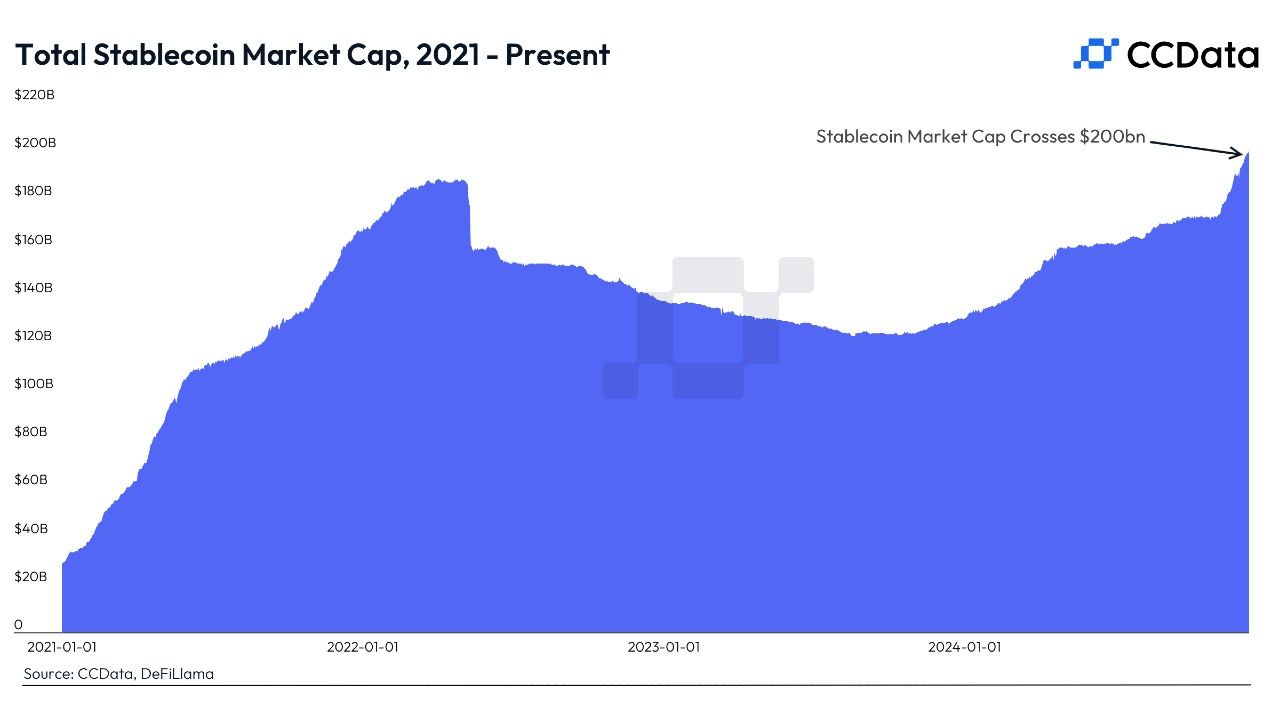

Table 2: Stablecoin Market Cap Growth

| Year | Total Market Cap | Key Driver |

|---|---|---|

| 2021–2023 | $100–150B range | DeFi boom |

| 2024–2026 | Crossed $200B | Payments, remittances, institutional use |

Community Sentiment on Reddit

Discussions reflect the divide. A recent r/Bogleheads thread highlights how Bitcoin’s drawdown exposed myths around its safe-haven status while gold performed strongly.

Conclusion: An Evolving Narrative

Bitcoin’s “digital gold” story faces real challenges in 2026, with gold outperforming and stablecoins capturing utility. Long-term, BTC’s scarcity remains a powerful thesis, but short-term it trades more like a growth asset.

Diversification across gold, Bitcoin, and regulated stablecoins offers balanced exposure. Always conduct your own research and consider professional advice.

Subscribe to Flux Market for daily finance insights and market updates.

References

- Reddit r/btc. “Gold (+55%) is the best performing major asset in 2025 while Bitcoin…” Accessed Feb 15, 2026. Link

- Reddit r/Bogleheads. “Bitcoin’s 50% Collapse Exposes Two Industry Myths.” Accessed Feb 15, 2026. Link

- CoinDesk. “Stablecoin Market Cap Hits $200B Milestone.” Dec 2024 (updated trends). Link

- River Financial. “Bitcoin vs Gold Supply Comparison.” Accessed Feb 15, 2026. Link

- Volity. “Bitcoin vs Gold Investor Comparison.” Accessed Feb 15, 2026. Link

- X (Twitter) posts on Bitcoin as digital gold narrative, February 2026.

- Yahoo Finance and community market commentary, February 2026.

- Grayscale Research and similar reports on BTC-tech correlation.